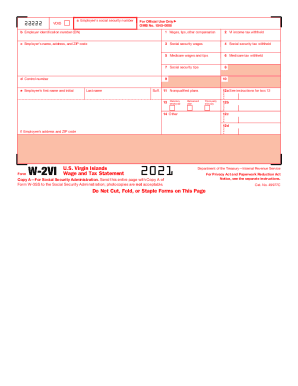

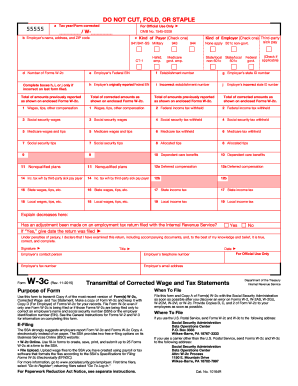

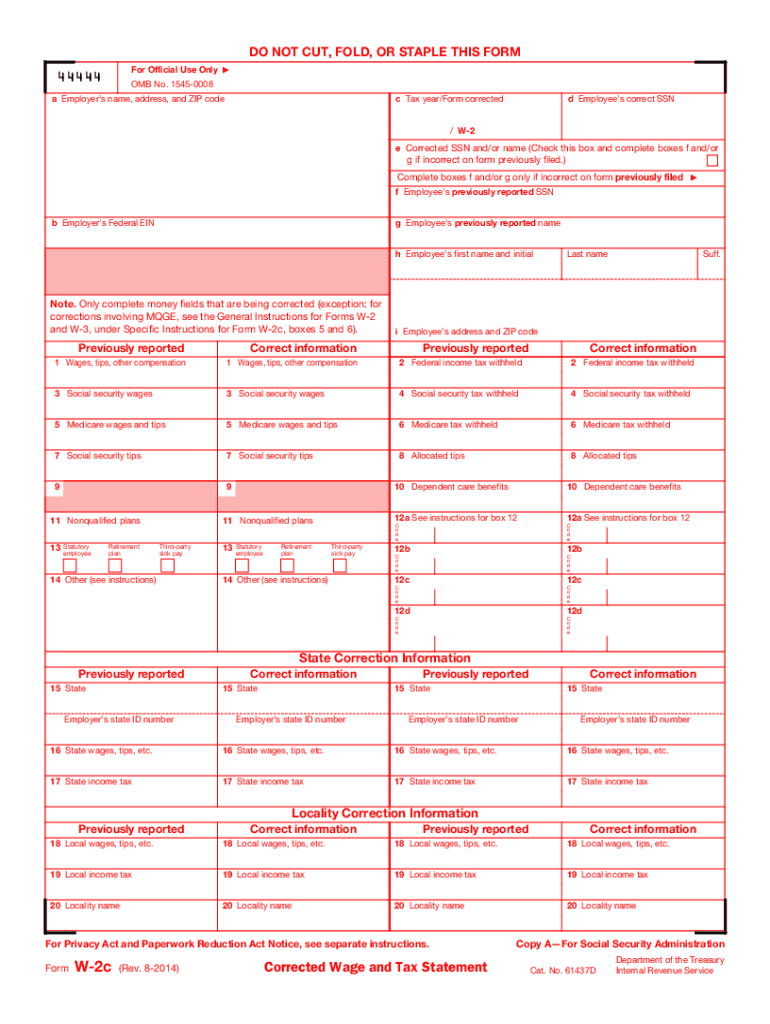

IRS W-2c 2014 free printable template

Instructions and Help about IRS W-2c

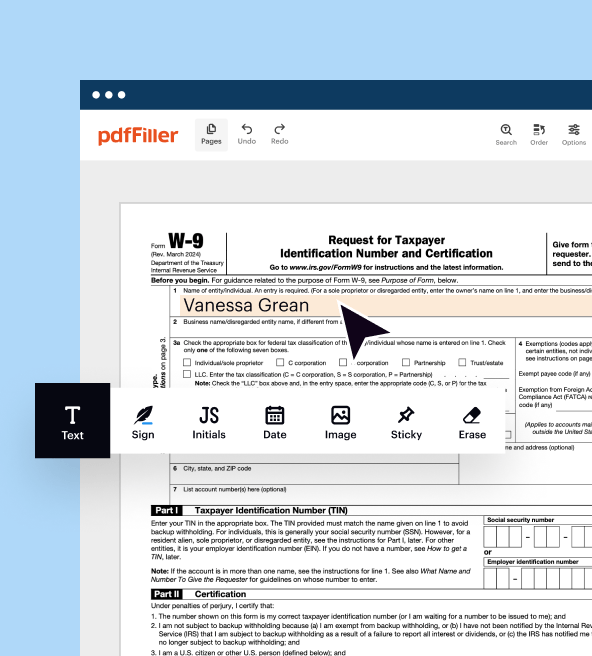

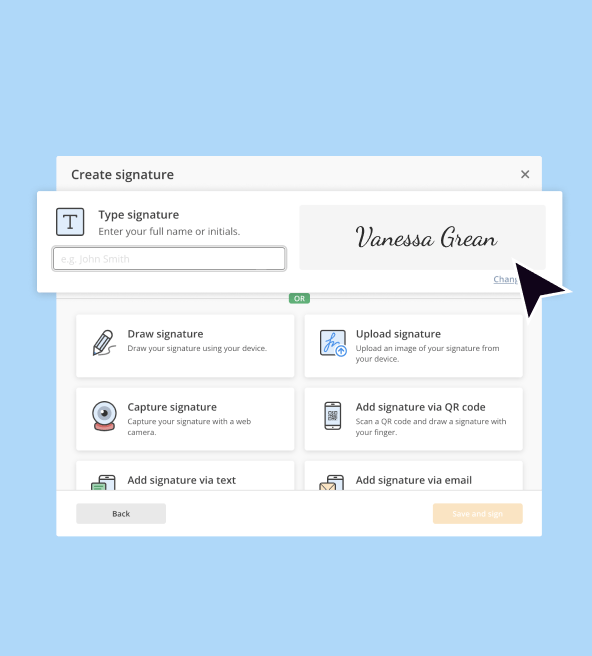

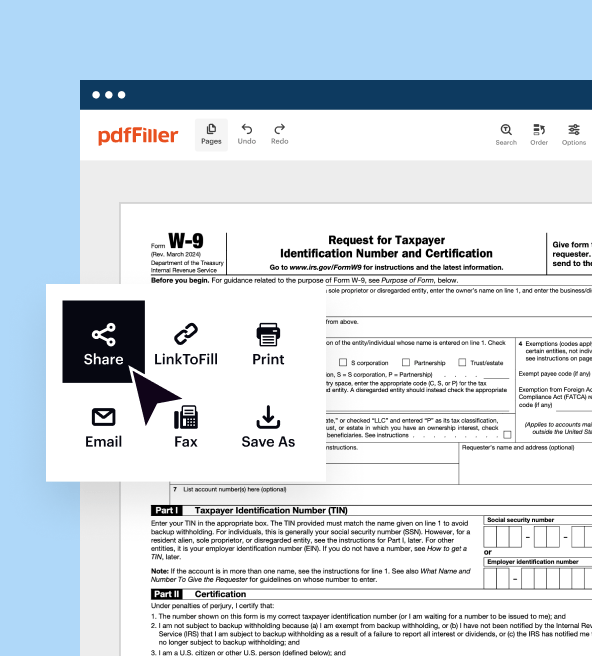

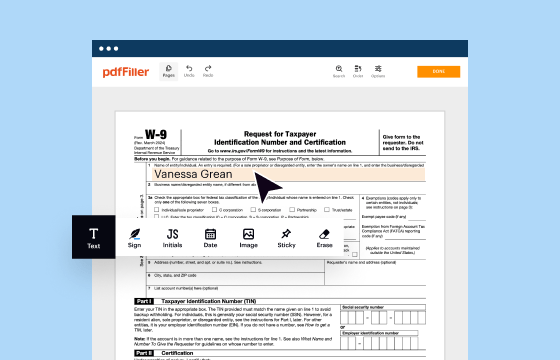

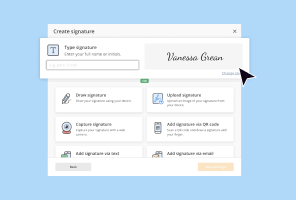

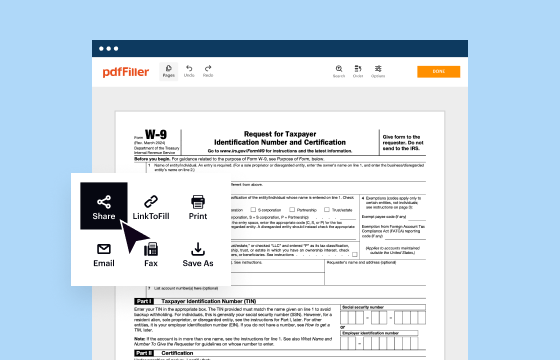

How to edit IRS W-2c

How to fill out IRS W-2c

About IRS W-2c 2014 previous version

What is IRS W-2c?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-2c

What should I do if I realize I've made an error on an already filed IRS W-2c?

If you find a mistake on a filed IRS W-2c, you should promptly submit a corrected version to the IRS and provide copies to the affected employees. Ensure that the correction includes accurate information for each employee, and keep a copy of both the original and corrected forms for your records.

How can I track my submission of the IRS W-2c to ensure it was processed?

To verify the status of your IRS W-2c submission, you can check the IRS's e-file status tool if you submitted electronically. If you submitted via mail, it may take several weeks for the IRS to process it, and you can contact them directly to inquire about its status.

What are some common mistakes to avoid when preparing the IRS W-2c?

Common errors on the IRS W-2c include incorrect employee names or Social Security numbers and miscalculating total wages or taxes withheld. Always double-check the information before submission to prevent processing delays and potential penalties.

What is the record retention period for the IRS W-2c?

For the IRS W-2c, you must retain copies of the form for at least four years from the date the tax was due or paid, whichever is later. This retention period helps ensure you have documentation if any issues arise related to the filing.

See what our users say